MagneGas Engineers a New and Disruptive Path in Alternative Energy

Posted: April 9, 2014 Filed under: Uncategorized | Tags: Acetylene, alternative energy, Co-combustion, MagneGas, NASDAQ, Sterilization Leave a commentCombining technology with energy to develop a highly disruptive technology in the alternative energy sector

One of the more obscure technology companies surged up the NASDAQ today on the announcement of a new energy patent. MagneGas (MNGE) announced today that it filed a new patent protecting new methods of applying MagneGas to existing hydrocarbons and other materials, according to this article on YahooFinance, and many others.

The stock was up 4 cents to trade at $1.59, a gain of 2.58 percent, according to NASDAQ.com.

The patent describes new methods of binding MagneGas, or hydrogen extracted from MagneGas, to hydrocarbon fuels and other material through a proprietary process.

The new patent is based on a provisional patent filed in April 2013 titled “Method and Apparatus for the Industrial Production of New Hydrogen-Rich Fuels.”The company believes that binding MagneGas to hydrocarbon fuels will improve fuel combustion efficiency resulting in reduced emissions.

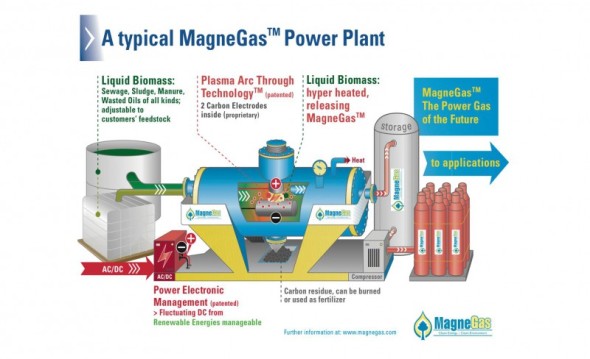

The company is based in Tarpon Springs, Fla. near Tampa and may be on the cusp of revolutionizing an industry. It has already developed its trademarked MagneGas, a natural gas alternative and metal working fuel that can be made from certain industrial, municipal, agricultural and military liquid wastes. This, the company says has become a popular alternative to acetylene. It is unique because it uses recycles liquid waste through another patented process called Plasma Arc Flow to turn it into a natural gas alternative, which the company says has lower greenhouse gas emissions.

This new announcement pushes the company forward in the waste-to-energy market which is a $20 billion sector, according to this Seeking Alpha article.

Its CEO Ermanno Santilli says the company’s three main components are:

- Industrial production and commercialization of an industrial fuel called MagneGas; a cheaper, safer, and cleaner alternative to acetylene, which I believe is arguably the most dangerous industrial gas in the world.

- Sterilization; a technology that targets liquid wastes such as sewage and agricultural wastes and converts those into sterilized fertilizer and irrigation waters. This results in the production of MagneGas and the same quantity of sterilized liquid. In this mode the liquid is retained but completely sterilized.

- Co-combustion: A revolutionary technology of adding MagneGas in the process of combusting traditional energy sources like coal. This so called ‘co-combustion’ produces more energy, lowers costs and reduces CO2 emissions as well.

On March 31, it signed an expanded joint venture agreement with technology partner Future Energy Pty Ltd of Australia, according to its website. It also has a partnership with Nuova MagneGas Italia in Europe.

While MagneGas has a long way to go it seems poised to make a good market run, and is an interesting alternative energy company, and one that could prove an ecological boon, particularly for recycling wastewater. It’s worth keeping an eye, though as an investment it can’t be seen as anything other than risky, but with the potential for very high reward.

In the land of oil, fears of excess use

Posted: July 13, 2012 Filed under: Uncategorized | Tags: alternative energy, culture, Oil, Saudi Arabia 1 CommentStanley Reed at the New York Times tells of shifts occurring in Saudi Arabia’s culture, the role of oil, and latent fears of the future. It reminded us of a story we reported on May 24, “Keep oil for future, tap solar energy,” which tells of the Middle East oil giant is investing heavily in solar energy as a hedge against oil dependency.

“One of the cooler places to hang out in Saudi Arabia is a motor racing track built among grassy dunes on the outskirts of the capital, Riyadh. Wealthy drivers, including at least one prince, race their Porsches and Lamborghinis there in front of an adoring crowd of young Saudis — some of them wearing reversed baseball caps and baggy jeans.

“The twisty circuit is built to the highest specifications and managed with a big emphasis on safety. Still, it is hard not to see the track as emblematic of a Saudi and Gulf culture of lavish and ever-increasing consumption — fast cars, gargantuan shopping malls, grandiose homes — all dependent on abundant and cheap gasolineand electric power. Saudi Arabia’s oil use has nearly doubled over the last decade to 2.9 million barrels per day, about a third of what it usually produces.

“Saudi oil consumption cannot go on growing this way, a few Cassandras are warning. “It’s not sustainable because domestic consumption is growing at an alarming rate. It is going to eventually eat into exports,” said Paul Stevens, an energy expert at Chatham House, a research institute in London.

“Seeing the dangers of their countries’ enormous use of fossil fuels, some Saudi and Gulf energy officials are examining alternatives including solar and nuclear power. […]

“The oil states are also finding that they do not have enough natural gas to keep the lights on and the air-conditioning running, or to promise new factories. Power plants in places like Saudi Arabia and Kuwait are substituting oil, which is dirtier and less efficient than natural gas. Burning oil is also wasteful, because it could be exported. “Almost the entire Middle East is gas-short,” said Siamak Namazi of Access Consulting Group in Dubai.

“Until recently, most of the Gulf countries had little interest in natural gas. They flared it into the atmosphere in huge quantities. Qatar and Iran are the exceptions, with huge natural-gas reserves, but Qatar does not want to sell much natural gas at the rock-bottom prices prevailing in its neighbors, and Iran is politically isolated with an industry so ineptly managed that it is importing gas itself.

“These conundrums are pushing the Saudis and others to think about their energy use. Abu Dhabi has made the largest commitment to alternative energy so far through Masdar, which has received a lot of hype but is taking concrete action. The company is pursuing a range of initiatives, including large solar energy complexes at home and abroad and a research center in a joint venture with the Massachusetts Institute of Technology.

“Abu Dhabi has ordered four nuclear plants from South Korea. Not to be outdone, the Saudis are drawing up plans for an even bigger nuclear effort that could add to regional tensions.”

Economists without calculators

Posted: June 27, 2012 Filed under: Uncategorized | Tags: alternative energy, costs, Markets, Policy Leave a commentThe backlash against wind energy, for instance, is global and growing

Robert Bryce considers what he believes many advocates of carbon taxes and cap-and-trade don’t consider when pushing their green energy agenda — scalability. That is, whether, if say, windmills are the most perfect form of energy production with the least harm done to the environment, enough of them can be built to sustain a country, state, or the world’s energy needs, and, indeed whether it is even affordable.

Bryce is a senior fellow at the Manhattan Institute, which champions market-oriented policies. On the whole he finds the green revolution “a thoroughly inadequate response to a global issue.” And while not offering a better way, his column is more about recognizing the waste in money and time for projects that are not all they’re cracked up to be in the first place. WInd farms for instance, are increasingly facing resistance from communities which don’t care for the blighted landscapes or the environmental hazards.

A sample: “A simple bit of math shows that even with the rapid expansion that solar-energy and wind-energy capacity have had in the past few years, those two sources cannot even meet incremental global demand for electricity, much less make a dent in the world’s overall demand for hydrocarbons,” Bryce says.

“Between 1985 and 2011, global electricity generation increased by about 450 terawatt-hours per year. That’s the equivalent of adding about one Brazil (which used 485 terawatt-hours of electricity in 2010) to the electricity sector every year. And the International Energy Agency expects global electricity use to continue growing by about one Brazil per year through 2035.

“How much solar capacity would be needed to produce 450 terawatt-hours? Well, Germany has more installed solar-energy capacity than any other country, with some 25,000 megawatts of installed photovoltaic panels. In 2011, those panels produced 18 terawatt-hours of electricity. Thus, just to keep pace with the growth in global electricity demand, the world would have to install about 25 times as much photovoltaic capacity as Germany’s total installed base, and it would have to do so again every year.

“The scale problem is equally obvious when it comes to wind.”

To read the whole piece, click here.

A better way to get hydrogen from water

Posted: June 21, 2012 Filed under: Uncategorized | Tags: alternative energy, CalTech, hydrogen, water Leave a commentThe technology opens the door for producing hydrogen-fueled-cars

The MIT publication TechnologyReview is an enlightening read. Moreover, one does not need to be a scientist to read it or understand the subject matter. A case in point is this week’s article by Kevin Bullis explaining how new approaches can lead to beneficial breakthroughs in, this case, the energy industry.

“An experimental approach to splitting water might lead to a relatively cheap and clean method for large-scale hydrogen production that doesn’t require fossil fuels. The process splits water into hydrogen and oxygen using heat and catalysts made from inexpensive materials.

“Heat-driven water splitting is an alternative to electrolysis, which is expensive and requires large amounts of electricity. The new approach, developed by Caltech chemical-engineering professor Mark Davis, avoids the key problems with previous heat-driven methods of water splitting. It works at relatively low temperatures and doesn’t produce any toxic or corrosive intermediate products,” Bullis writes.

“Almost all the hydrogen used now in industrial processes, such as making gasoline, comes from reforming natural gas. If automakers start selling large numbers of hydrogen-fuel-cell vehicles, as they’ve said they plan to do eventually, the hydrogen for those is also likely to come from natural gas unless processes like the one at Caltech are commercialized.

“The basic approach in high-temperature water splitting is to heat up an oxidized metal to drive off oxygen, then add water. In Davis’s case, the starting material is magnesium oxide, and the reactions are facilitated by shuttling sodium ions in and out of it. ‘Without the sodium, the temperatures would go up well over 1,000 °C,’ Davis says. With it, the reactions work at temperatures of 850 °C or lower.”

Bullis notes the technology is probably far from being commercialized, as the rate of hydrogen production needs to be increased, for example. But, just as importantly, its a potential breakthrough discovery that can fundamentally change — and improve — or energy uses.

Britain looks to biomass as alternative

Posted: May 29, 2012 Filed under: Uncategorized | Tags: alternative energy, biomass, Europe, United Kingdom 1 CommentOne key uncertainty for the sector, however, is EU clean air legislation

The United Kingdom is aiming to get 15 percent of its energy from green sources by 2020, according to a story today in Business World, an Ireland-based publication, and it is targeting biomass as sustainable method of achieving its goal.

“Britain is placing Europe’s biggest bet on biomass as an alternative to polluting oil and coal and expensive gas, but reliance on imports could challenge the plan’s low-carbon credentials and Britain’s energy security. Burning wood, sunflower husks or animal faeces offers steady so-called “baseload” power, giving biomass an advantage over intermittent renewable rivals solar and wind. It also offers an alternative to Europe’s gas-fired power plants, where profits have been eroded by rising natural gas prices. One way biomass is finding a way into the UK’s energy mix is through the conversion of coal-burning power plants, which saves up to 75 percent of the cost of building a new station.”

However, there is a catch, as the article notes, the UK hs scant domestic supply, which will mean most of the UK’s supply will have to be shipped from far-away places such as Canada or Australia.

“[That is] raising questions about just how ‘green’ the plans will prove. With the UK’s biomass consumption expected to rise tenfold in the next 25 years, there are also concerns it could be vulnerable to supply disruptions from a handful of overseas exporters in the forest industry, where analysts say long-term supply deals are relatively rare.”